Shareholder Basis Worksheet Pdf

Capital Gains and Losses and Built-in Gains. TaxAct supports the ability to attach the shareholders basis worksheet when required.

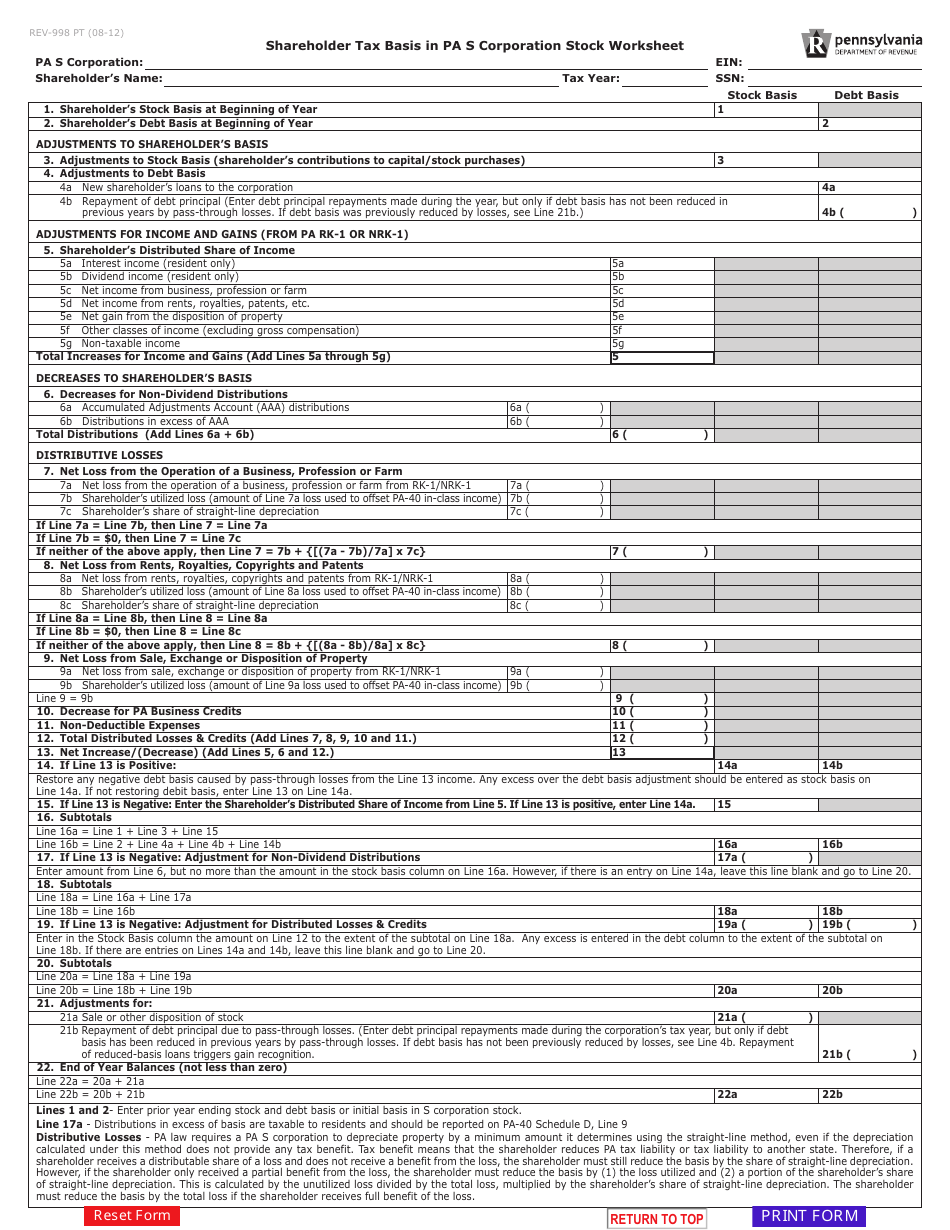

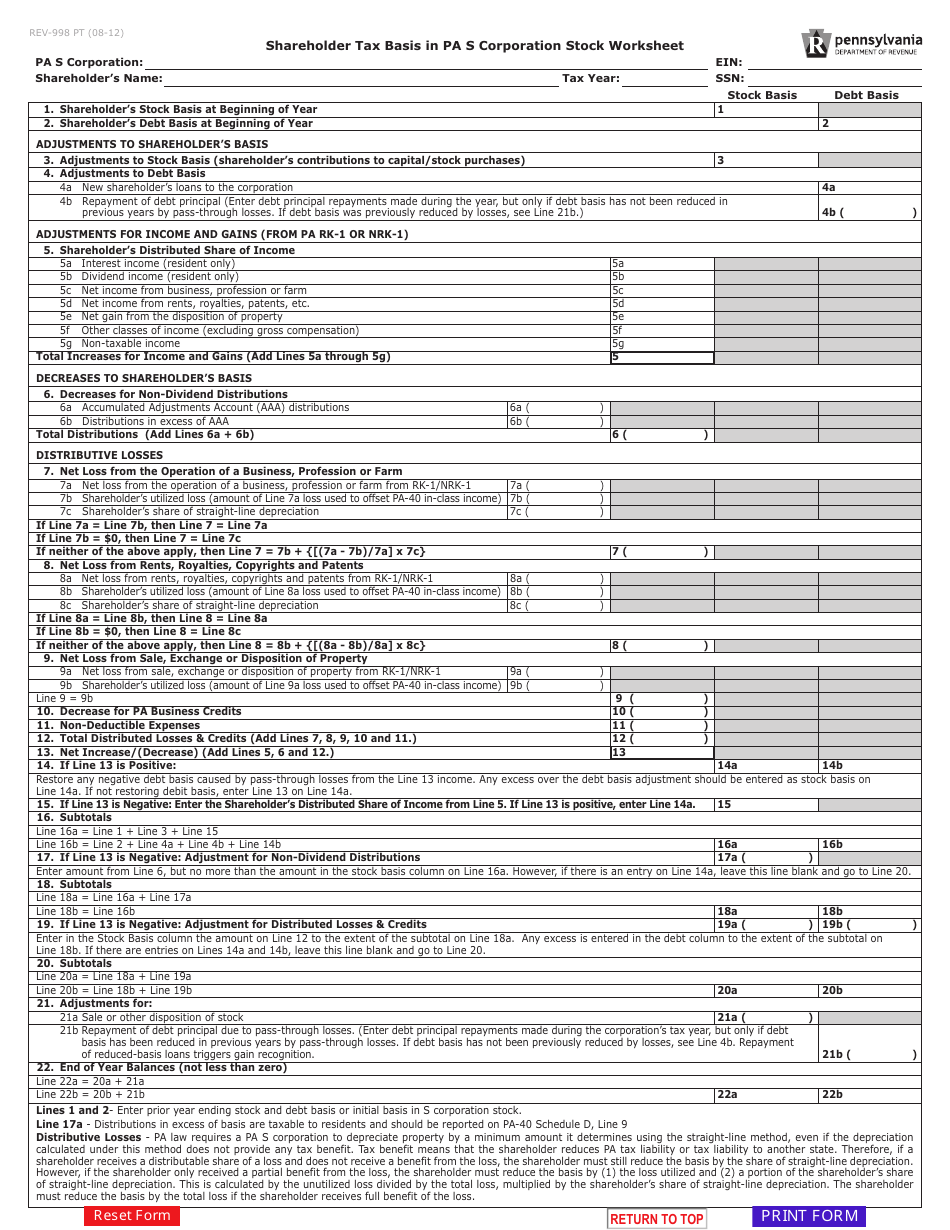

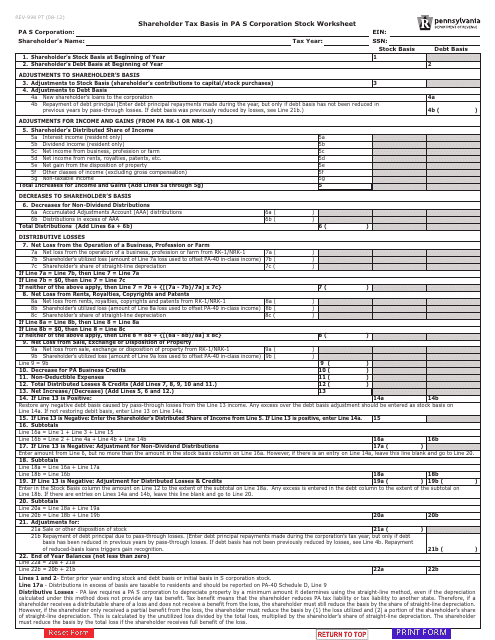

Form Rev 998 Download Fillable Pdf Or Fill Online Shareholder Tax Basis In Pa S Corporation Stock Worksheet Pennsylvania Templateroller

1366d Basis of stock reduced first then debt.

. Please see the last page of this article for a sample of a Shareholders Basis Worksheet. Basis is increased by a all income including tax-exempt income reported on Schedule K-1 and b the excess of the deduction for depletion other than oil and gas depletion over the basis of the property subject to depletion. More Than One Activity for At-Risk Purposes.

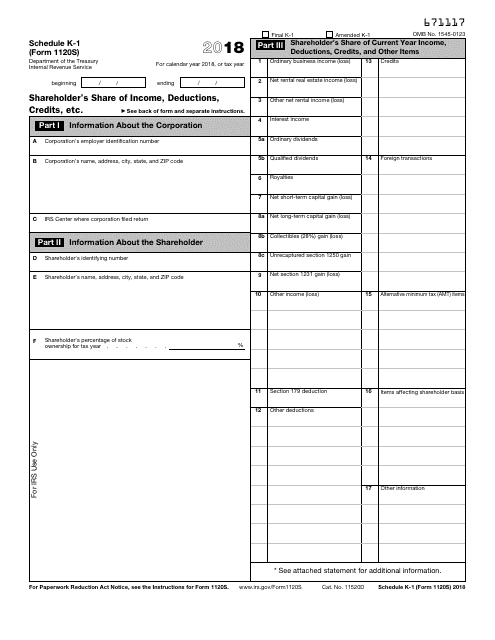

The IRS made several revisions to the individual income tax return Form 1040 during the 2018 tax filing season. During the e-filing steps youll be presented an option to Attach. Basis for S Shareholders The Basics.

Below are instructions on how to enter the information from the S Corporation worksheet into the 1040 K-1 input screens. Shareholder receives a distributable share of a loss and does not receive a benefit from the loss the shareholder must still reduce the basis by the share of straight-line depreciation. In addition basis may be adjusted under other provisions of the Internal Revenue Code.

Generally the deduction for your share of aggregate losses and deductions reported on Schedule K-1 is limited to the basis of your stock and loans from you to the corporation. The basis of your stock generally its cost is adjusted annually as follows and except as noted in the order listed. See Tab A for a blank worksheet.

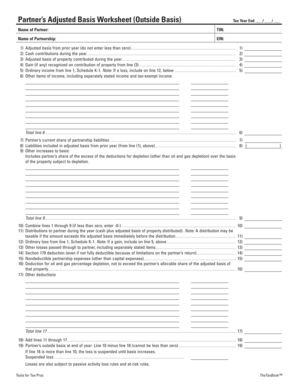

Information on shareholder basis can be found in the instructions for Schedule K-1 Form 1120S. Partners Basis Every partner must keep track of his adjusted basis in the partnership. Basis can come from and records should be maintained of.

Purchase of shares Records of amount paid for same 2. 23 Shareholders adjusted stock basis at the end of the year Line 17 less lines 20 and 22. The line numbers in the following table refer to the line numbers on the Shareholder Ba.

REV-998 - Shareholder Tax Basis in PA S Corporation Stock Worksheet free download and preview download free printable template samples in PDF Word and Excel formats. One of the changes includes a new requirement for S-corporation shareholders to attach a tax basis schedule to their income tax return if any of the following occur. Results UltraTax CS generates Schedule E Page 2 Figure 11.

However if the shareholder only received a partial benefit from the loss the shareholder must reduce the basis by 1 the loss utilized and 2 a portion of. Shareholder Basis Worksheet field must be marked to produce the Shareholders Basis Worksheet. Once you complete the basis worksheet screens you must also attach that worksheet as a PDF.

You should generally use the Worksheet for Figuring a Shareholders Stock and Debt Basis to figure your aggregate stock and debt basis. Select Do NOT attach the IRS Worksheet for Figuring a Shareholder Stock and Debt Basis even though it may be required See Screen PDF and FAQ item GG for information on attaching PDF documents to a return. PART I -- SHAREHOLDERS STOCK.

Importance of Basis One of three limits on deducting a loss Required attachment to tax return for an S corporation shareholder claiming a loss Must know basis to determine if Distribution is taxable Partnership or S corporation Repayment of debt taxable S corporation Used to compute gainloss on disposition of asset 2. Normally a shareholder that has basis in the company can reduce their other income W-2 wages interest dividends rental etc on their personal tax return with the losses of the company. The IRS published a notice in the Federal Register on July 19 2021 asking for comments on a new Form 7203 S Corporation Shareholder Stock and Debt Basis Limitations and related instructions.

Click the Basis Worksheet Continued tab. PDF Attachment Option for K-1 Basis Worksheet. Basis as part of a IRC 351 exchange Worksheet showing Net Basis of Assets less Liabilities Exchanged.

Items Affecting Shareholder Basis. To the shareholder Sec. Per the Shareholders Instructions for Schedule K-1 Form 1120S page 2.

The worksheet is available from screen K1 by using the Basis Wks tab at the top of the screen. Use the Worksheet for Figuring a Shareholders Stock and Debt Basis to figure your aggregate stock and debt basis. A loss is reported on the Schedule K-1.

Enter the prior-year suspended losses from the S Corporation activity Figure 10. A partner cannot deduct a loss in excess of his ad-justed basis. Basis is tracked at both the 1120-S level and the 1040 level however the worksheets are not always the same between the 1120-S and 1040 returns.

Form 1120-S Schedule K-1 Shareholders Share of Income Deductions Credits etc. The notice describes the proposed form in an abstract section as follows. The partners adjusted basis is used to determine the amount of loss deductible by the partner.

Do not attach the worksheet to Form 1065 or Form 1040. A distribution is received. This article refers to screen Shareholders Adjusted Basis Worksheet in the 1120-S S corporation package.

In order to see this option during the e-filing steps the basis computation required field must be checked on the Schedule K-1 1120-S. S shareholder losses limited to basis in Stock and Debt of the S corp. More Than One Activity for Passive Activity Purposes.

In addition basis may be adjusted under other provisions of the Internal Revenue Code. Inst 1120-S Schedule D Instructions for Schedule D Form 1120S Capital Gains and Losses and Built-In Gains. Internal Revenue Code IRC Section 1366 determines the shareholders tax liability from an S corporation.

The basis of your stock generally its cost is adjusted annually as follows and except as noted in the order listed. The shareholder to the S corporation as well as any loan repayments and 3All the items that increase and decrease stock basis since the corporation has been an S corporation or since the shareholder first acquired stock ie. Any current undistributed income restores prior basis reductions of debt before increasing stock basis Sec.

2019 FEDERAL S CORPORATION K-1 SHAREHOLDERS OUTSIDE BASIS WORKSHEET Keep for Your Records S Corporation Name. Shareholders Basis Worksheet Page 1. Computing Basis With Historical Records.

Click the K1-8 tab. The S Corporation program in Lacerte generates the Shareholder Basis Computation worksheet. You should generally use the Worksheet for Figuring a Shareholders Stock and Debt Basis to figure your aggregate stock and debt basis.

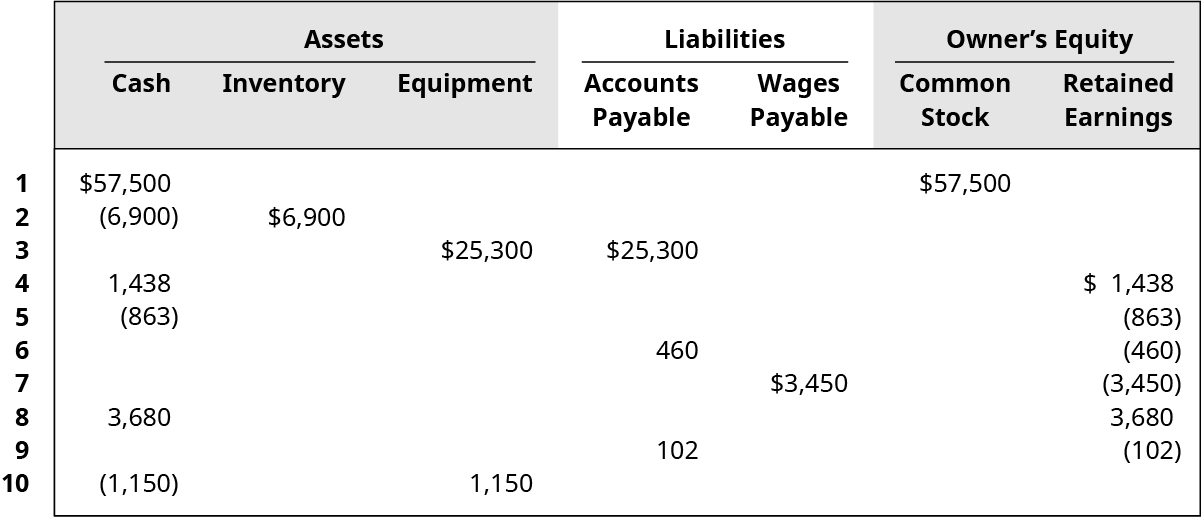

Prepare An Income Statement Statement Of Owner S Equity And Balance Sheet Principles Of Accounting Volume 1 Financial Accounting

Partnership Basis Calculation Worksheet Excel Fill Online Printable Fillable Blank Pdffiller

Partnership Basis Calculation Worksheet Excel Fill Online Printable Fillable Blank Pdffiller

Logistics Terms And Supply Chain Glossary Pdf File

Form Rev 998 Download Fillable Pdf Or Fill Online Shareholder Tax Basis In Pa S Corporation Stock Worksheet Pennsylvania Templateroller

Form Rev 998 Shareholder Tax Basis In Pa S Corporation Stock Worksheet Rev 998

Preparing Financial Projections And Monitoring Results Alberta Ca

:max_bytes(150000):strip_icc()/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)

Form 1120 S U S Income Tax Return For An S Corporation Definition

Preparing Financial Projections And Monitoring Results Alberta Ca

Financial Statements Examples Amazon Case Study

Irs Form 1120s Schedule K 1 Download Fillable Pdf Or Fill Online Shareholder S Share Of Income Deductions Credits Etc 2018 Templateroller